Nokia sale to Microsoft expected to close on April 25

Nokia sale to Microsoft expected to close on April 25

It was nearly eight months ago that Microsoft and Nokia announced a deal to sell Nokia's Devices and Services unit to Microsoft for €5.44 billion (US$7.three billion), and this week that bargain is finally going to close. Friday, April 25th, volition come across Nokia Devices and Services transferred to Microsoft and renamed as Microsoft Mobile Oy.

The process was expect to take a several months, and unsurprisingly so big of an conquering of so iconic a company as Nokia ran into some hurdles. But it wasn't the U.s.a. Department of Justice, the European Commission, or even Nokia shareholders that caused issues — it was a massive revenue enhancement bill the Indian government claimed Nokia owed that concluded with more half a billion dollars put into an escrow account, too as concerns raised by Korean manufacturers to the Off-white Trade Committee

With all of that out of the manner, Nokia anticipates that only "certain customary closing conditions" remain between at present and Friday's closing.

Brad Smith, Microsoft General Counsel and EVP Legal & Corporate Affairs, chimed in on the Official Microsoft Blog:

"The completion of this acquisition follows several months of planning and volition mark a key pace on the journeying towards integration. This acquisition will assist Microsoft advance innovation and market adoption for Windows Phones. In addition, nosotros look forward to introducing the next billion customers to Microsoft services via Nokia mobile phones."

He noted that adjustments have been made since the announcement of the deal. Microsoft will now exist taking over direction of Nokia.com and Nokia'south social media accounts, Nokia'south Master Technology Office and its 21 employees in Red china will exist joining Microsoft, and Nokia'due south Korean manufacturing facility with stay with the remnants of Nokia and not become property of Microsoft.

Adieu, Nokia. Hello, Microsoft Mobile.

Press release:

Nokia expects the sale of essentially all of its Devices & Services business to Microsoft to close on April 25, 2022

Espoo, Finland - Nokia today announced that it expects the transaction whereby the visitor will sell essentially all of its Devices & Services concern to Microsoft to close on April 25, 2022. The transaction is now subject but to sure customary closing conditions.

The transaction was originally announced on September 3, 2022.

FORWARD-LOOKING STATEMENTS

Information technology should be noted that Nokia and its concern are exposed to various risks and uncertainties and certain statements herein that are not historical facts are frontward-looking statements, including, without limitation, those regarding: A) the planned sale by Nokia of substantially all of Nokia'south Devices & Services concern, including Smart Devices and Mobile Phones (referred to below as "Sale of the D&South Business") pursuant to the Stock and Asset Purchase Agreement, dated as of September ii, 2022, between Nokia and Microsoft International Holdings B.Five.(referred to beneath as the "Agreement"); B) the closing of the Sale of the D&S Concern; C) expectations, plans or benefits related to or caused by the Auction of the D&S Business; D) expectations, plans or benefits related to Nokia'southward strategies, including plans for Nokia with respect to its continuing businesses that will not be divested in connection with the Auction of the D&South Business organisation; E) expectations, plans or benefits related to changes in leadership and operational structure; F) expectations and targets regarding our operational priorities, financial performance or position, results of operations and utilise of proceeds from the Sale of the D&Due south Business; and Grand) statements preceded past "believe," "expect," "anticipate," "foresee," "sees," "target," "judge," "designed," "aim", "plans," "intends," "focus," "will" or like expressions. These statements are based on management'southward all-time assumptions and behavior in light of the information currently bachelor to it. Because they involve risks and uncertainties, actual results may differ materially from the results that we currently expect. Factors, including risks and uncertainties that could crusade these differences include, but are not express to: ane) the inability to close the Sale of the D&S Business in a timely mode, or at all, for instance due to the disability or delays in satisfying closing conditions, or the occurrence of any effect, change or other circumstance that could give rise to the termination of the Agreement; 2) the potential adverse result on the sales of our mobile devices, business concern relationships, operating results and business generally resulting from the announcement of the Sale of the D&S Business or from the terms that we accept agreed for the Auction of the D&Due south Business organisation; three) any negative effect from the implementation of the Sale of the D&Southward Business, as we may forego other competitive alternatives for strategies or partnerships that would benefit our Devices & Services business and if the Auction of the D&S Business is not airtight, we may have limited options to keep the Devices & Services concern or enter into another transaction on terms favorable to the states, or at all; 4) our ability to effectively and smoothly implement planned changes to our leadership and operational structure or maintain an efficient interim governance structure and preserve or hire fundamental personnel; v) whatsoever negative effect from the implementation of the Sale of the D&S Business concern, including our internal reorganization in connexion therewith, which volition require meaning time, attention and resources of our senior direction and others inside the visitor potentially diverting their attention from other aspects of our business organization; 6) disruption and dissatisfaction amid employees caused by the plans and implementation of the Sale of the D&S Business reducing focus and productivity in areas of our business organisation; 7) the amount of the costs, fees, expenses and charges related to or triggered by the Auction of the D&S Business organization; viii) any impairments or charges to carrying values of assets or liabilities related to or triggered by the Auction of the D&Southward Business; 9) potential adverse effects on our business organisation, properties or operations acquired by us implementing the Sale of the D&S Business organisation; 10) the initiation or outcome of any legal proceedings, regulatory proceedings or enforcement matters that may be instituted against us relating to the Sale of the D&Southward Business, as well every bit the risk factors specified on pages 12-47 of Nokia'south almanac report on Grade 20-F for the yr ended December 31, 2022 under Item 3D. "Risk Factors." and risks outlined in our fourth quarter and total year 2022 results written report available for case at www.nokia.com/financials. Other unknown or unpredictable factors or underlying assumptions subsequently proving to be wrong could cause actual results to differ materially from those in the forrard-looking statements. Nokia does non undertake whatsoever obligation to publicly update or revise forward-looking statements, whether as a event of new information, time to come events or otherwise, except to the extent legally required.

Source: Nokia, Microsoft

We may earn a committee for purchases using our links. Learn more.

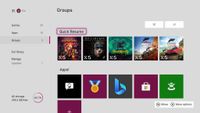

Xbox Insiders Update

This huge Xbox 'Quick Resume' update will give gamers more control

Microsoft is adding a new feature to Xbox consoles, allowing you to permanently store up to two games in a Quick Resume country at all times. The characteristic is heading out first to Xbox Insiders in the Blastoff testing ring before hitting the general public.

Solid Foundations

ASUS ROG Strix X570-Eastward is the all-time motherboard for Ryzen ix 5900X

The motherboard can prove a blessing or a hindrance when used with loftier-performance processors like the AMD Ryzen 9 5900X, depending on which you get for. We've rounded upwardly the best B550 and X570 motherboards that are compatible with the new Ryzen processor.

Source: https://www.windowscentral.com/nokia-sale-microsoft-expected-close-april-25

Posted by: eaglewelinigh.blogspot.com

0 Response to "Nokia sale to Microsoft expected to close on April 25"

Post a Comment