How Can Millenials Change Things When They Have No Money

Why millennials are facing the scariest financial future of any generation since the Great Depression.

Like anybody in my generation, I am finding information technology increasingly difficult not to be scared about the future and angry near the past.

I am 35 years old—the oldest millennial, the first millennial—and for a decade now, I've been waiting for machismo to kick in. My rent consumes almost half my income, I haven't had a steady task since Pluto was a planet and my savings are dwindling faster than the water ice caps the infant boomers melted.

What'southward a millennial anyway?

Unless otherwise noted, we hateful anyone born between 1982 and 2004

We've all heard the statistics. More than millennials live with their parents than with roommates. Nosotros are delaying partner-marrying and firm-ownership and child-having for longer than any previous generation. And, co-ordinate to The Olds, our problems are all our fault: We got the wrong caste. We spend money we don't have on things we don't need. We still haven't learned to code. We killed cereal and department stores and golf game and napkins and lunch. Mention "millennial" to anyone over 40 and the word "entitlement" will come back at you within seconds, our own intergenerational game of Marco Polo.

This is what it feels similar to be young now. Not only are we screwed, but we have to listen to lectures near our laziness and our participation trophies from the people who screwed us.

But generalizations nearly millennials, like those nigh whatsoever other arbitrarily defined grouping of 75 meg people, fall autonomously under the slightest scrutiny. Contrary to the cliche, the vast majority of millennials did not go to college, exercise not work every bit baristas and cannot lean on their parents for assist. Every stereotype of our generation applies only to the tiniest, richest, whitest sliver of young people. And the circumstances we live in are more than dire than most people realize.

But it'due south non just the numbers.

What is different about united states equally individuals compared to previous generations is minor. What is unlike virtually the earth effectually us is profound. Salaries take stagnated and unabridged sectors have cratered. At the same time, the price of every prerequisite of a secure being—education, housing and health care—has inflated into the stratosphere. From job security to the social safety net, all the structures that insulate us from ruin are eroding. And the opportunities leading to a middle-course life—the ones that boomers lucked into—are beingness lifted out of our reach. Add together it all up and it's no surprise that we're the first generation in modern history to end upwardly poorer than our parents.

Glossary for Grandad

Terms to know but never say out loud

FML Fuck My Life

FTW For The Win

TFW That Feeling When

This is why the touchstone experience of millennials, the affair that truly defines us, is not helicopter parenting or unpaid internships or Pokémon Become. It is uncertainty. "Some days I breathe and it feels like something is about to burst out of my breast," says Jimmi Matsinger. "I'm 25 and I'm nevertheless in the same identify I was when I earned minimum wage." Four days a calendar week she works at a dental function, Fridays she nannies, weekends she babysits. And still she couldn't keep up with her rent, auto lease and pupil loans. Earlier this year she had to borrow money to file for bankruptcy. I heard the aforementioned walls-closing-in feet from millennials around the country and across the income scale, from cashiers in Detroit to nurses in Seattle.

It's tempting to await at the recession as the cause of all this, the Great Fuckening from which nosotros are still waiting to recover. Merely what nosotros are living through now, and what the recession merely accelerated, is a historic convergence of economical maladies, many of them decades in the making. Conclusion by decision, the economic system has turned into a young people-screwing machine. And unless something changes, our calamity is going to become America's.

Understanding structural disadvantage is pretty complicated. You'll need a guide.

hat Scott remembers are the group interviews.

Eight, ten people in suits, a circle of folding chairs, a chirpy HR rep with a clipboard. Each applicant telling her, i by one, in front of all the others, why he's the right candidate for this $11-an-hour job equally a bank teller.

Information technology was 2010, and Scott had just graduated from college with a bachelor's in economics, a minor in business organisation and $30,000 in pupil debt. At some of the interviews he was by far the least qualified person in the room. The other applicants described their corporate jobs and listed off graduate degrees. Some looked like they were in their 50s. "One fourth dimension the 60 minutes rep told us she did these three times a week," Scott says. "And I just knew I was never going to get a job."

Afterwards six months of applying and interviewing and never hearing back, Scott returned to his loftier school chore at The Old Spaghetti Factory. After that he bounced effectually—selling suits at a Nordstrom outlet, cleaning carpets, waiting tables—until he learned that city coach drivers earn $22 an hour and get full benefits. He'south been doing that for a year at present. It's the most coin he'due south ever made. He notwithstanding lives at home, chipping in a few hundred bucks every month to aid his mom pay the rent.

In theory, Scott could apply for banking jobs again. Just his degree is most eight years quondam and he has no relevant experience. He sometimes considers getting a master'due south, but that would mean walking abroad from his salary and benefits for ii years and taking on some other five digits of debt—only to snag an entry-level position, at the age of xxx, that would pay less than he makes driving a bus. At his electric current chore, he'll exist able to move out in six months. And pay off his student loans in 20 years.

There are millions of Scotts in the modernistic economic system. "A lot of workers were just eighteen at the wrong time," says William Spriggs, an economics professor at Howard University and an assistant secretary for policy at the Department of Labor in the Obama administration. "Employers didn't say, 'Oops, we missed a generation. In 2008 we weren't hiring graduates, let's hire all the people we passed over.' No, they hired the class of 2012."

Yous tin even come across this in the statistics, a divot from 2008 to 2012 where millions of jobs and billions in earnings should be. In 2007, more than than l percent of college graduates had a chore offering lined up. For the class of 2009, fewer than 20 percent of them did. According to a 2010 study, every 1 percent uptick in the unemployment charge per unit the year you graduate college ways a 6 to viii percent drop in your starting bacon—a disadvantage that can linger for decades. The same study plant that workers who graduated during the 1981 recession were yet making less than their counterparts who graduated ten years afterwards. "Every recession," Spriggs says, "creates these cohorts that never recover."

The Class of Oh No

Heaven help you if you lot graduated on the wrong side of the recession.

'07 grad '09 grad

Over 10 years, the typical '09 grad could earn upwardly to0less than the typical '07 grad.

Sources: "Cashier or Consultant? Entry Labor Market Conditions, Field of Report, and Career Success," by Joseph G. Altonji, Lisa B. Kahn & Jamin D. Speer, Journal of Labor Economic science, 2016; and "The long-term labor market consequences of graduating from college in a bad economy," by Lisa B. Kahn, Labour Economics, 2010. Projections assume initial earnings of $fifty,000 and are based on the researchers' assay of earnings during periods of growth and recession from 1980 to 2011.

By now, those unlucky millennials who graduated at the incorrect time have cascaded down through the economy. Some estimates show that 48 percent of workers with available's degrees are employed in jobs for which they're overqualified. A academy diploma has practically become a prerequisite for fifty-fifty the lowest-paying positions, just another slice of newspaper to flash in front of the hiring managing director at Quiznos.

Just the real victims of this credential inflation are the two-thirds of millennials who didn't get to higher. Since 2010, the economy has added xi.6 million jobs—and 11.v one thousand thousand of them take gone to workers with at least some college education. In 2016, young workers with a loftier school diploma had roughly triple the unemployment rate and 3 and a one-half times the poverty rate of college grads.

Once you start tracing these trends astern, the recession starts to look less like a temporary setback and more like a culmination. Over the concluding 40 years, as politicians and parents and perky magazine listicles have been telling us to report hard and build our personal brands, the unabridged economy has transformed beneath us.

For decades, well-nigh of the chore growth in America has been in low-wage, low-skilled, temporary and curt-term jobs. The U.s. but produces fewer and fewer of the kinds of jobs our parents had. This explains why the rates of "under-employment" among loftier school and higher grads were rising steadily long before the recession. "The manner to think about it," says Jacob Hacker, a Yale political scientist and author of The Great Take a chance Shift, "is that there are waves in the economy, but the tide has been going out for a long fourth dimension."

The decline of the chore has its principal origins in the 1970s, with a meg piffling changes the boomers barely noticed. The Federal Reserve cracked down on aggrandizement. Companies started paying executives in stock options. Alimony funds invested in riskier assets. The cumulative result was money pouring into the stock market similar jet fuel. Betwixt 1960 and 2013, the average fourth dimension that investors held stocks earlier flipping them went from 8 years to around four months. Over roughly the same period, the financial sector became a sarlacc pit encompassing around a quarter of all corporate profits and completely warping companies' incentives.

The force per unit area to deliver immediate returns became relentless. When stocks were long-term investments, shareholders let CEOs spend money on things like worker benefits considering they contributed to the company's long-term health. One time investors lost the ability to look beyond the next earnings report, however, any motility that didn't boost short-term profits was tantamount to treason.

The new image took over corporate America. Individual equity firms and commercial banks took corporations off the market place, laid off or outsourced workers, then sold the businesses back to investors. In the 1980s alone, a quarter of the companies in the Fortune 500 were restructured. Companies were no longer single entities with responsibilities to their workers, retirees or communities.

Businesses applied the aforementioned chop-store logic to their own operations. Executives came to see themselves every bit first and foremost in the shareholder-pleasing game. Higher staff salaries became luxuries to exist slashed. Unions, the great negotiators of wages and benefits and the guarantors of severance pay, became enemy combatants. And somewhen, employees themselves became liabilities. "Corporations decided that the fastest mode to a higher stock cost was hiring office-fourth dimension workers, lowering wages and turning their existing employees into contractors," says Rosemary Batt, a Cornell University economist.

Boomer

Millennial

Hours of minimum wage work needed to pay for four years of public higher

Source: National Center for Education Statistics. Calculations based on tuition for four-yr public universities from 1973-1976 and 2003-2006.

Xxx years ago, she says, you could walk into whatever hotel in America and anybody in the building, from the cleaners to the security guards to the bartenders, was a straight rent, each worker on the same pay scale and enjoying the same benefits as everyone else. Today, they're almost all indirect hires, employees of random, anonymous contracting companies: Laundry Inc., Rent-A-Guard Inc., Watery Margarita Inc. In 2015, the Authorities Accountability Function estimated that forty percent of American workers were employed nether some sort of "contingent" organisation similar this—from barbers to midwives to radioactive waste inspectors to symphony cellists. Since the downturn, the industry that has added the most jobs is not tech or retail or nursing. Information technology is "temporary help services"—all the small, no-brand contractors who recruit workers and hire them out to bigger companies.

The effect of all this "domestic outsourcing"—and, allow'due south be honest, its actual purpose—is that workers become a lot less out of their jobs than they used to. One of Batt'due south papers establish that employees lose up to 40 pct of their salary when they're "re-classified" as contractors. In 2013, the city of Memphis reportedly cut wages from $15 an hour to $10 after it fired its school motorbus drivers and forced them to reapply through a staffing agency. Some Walmart "lumpers," the warehouse workers who carry boxes from trucks to shelves, accept to bear witness up every morning just only get paid if there'southward enough work for them that day.

"This is what's really driving wage inequality," says David Weil, the former caput of the Wage and Hour Partition of the Section of Labor and the author of The Fissured Workplace. "Past shifting tasks to contractors, companies pay a cost for a service rather than wages for work. That means they don't have to think about preparation, career advancement or benefit provision."

This transformation is affecting the unabridged economy, but millennials are on its front lines. Where previous generations were able to aggregate years of solid feel and income in the old economy, many of united states will spend our entire working lives intermittently employed in the new one. We'll get less preparation and fewer opportunities to negotiate benefits through unions (which used to encompass 1 in 3 workers and are now down to around 1 in 10). Plus, as Uber and its "gig economy" ilk perfect their algorithms, we'll be increasingly at the mercy of companies that only want to pay us for the time we're generating acquirement and not a second more.

But the arraign doesn't but fall on companies. Trade groups have responded to the dwindling number of secure jobs by digging a moat around the few that are left. Over the terminal 30 years, they've successfully lobbied state governments to require occupational licenses for dozens of jobs that never used to demand them. It makes sense: The harder information technology is to go a plumber, the fewer plumbers there will exist and the more each of them can charge. Nearly a third of American workers now need some kind of state license to exercise their jobs, compared to less than v percent in 1950. In most other developed countries, yous don't need official permission to cut hair or cascade drinks. Here, those jobs tin require up to $twenty,000 in schooling and 2,100 hours of educational activity and unpaid exercise.

In sum, nearly every path to a stable income now demands tens of thousands of dollars before you get your first paycheck or have any thought whether yous've chosen the right career path. "I was literally paying to work," says Elena, a 29-year-former dietician in Texas. (I've changed the names of some of the people in this story because they don't want to go fired.) As part of her master'south degree, she was required to do a yearlong "internship" in a hospital. It was supposed to be training, but she says she worked the same hours and did the same tasks every bit paid staffers. "I took out an extra $xx,000 in student loans to pay tuition for the year I was working for gratis," she says.

All of these trends—the toll of education, the ascension of contracting, the barriers to skilled occupations—add together upwardly to an economic system that has deliberately shifted the gamble of economic recession and industry disruption away from companies and onto individuals. For our parents, a job was a guarantee of a secure machismo. For u.s.a., it is a hazard. And if we suffer a setback forth the fashion, there'south then little to go along usa from sliding into disaster.

Condign poor is not an effect. Information technology is a procedure.

Similar a plane crash, poverty is rarely caused past one thing going wrong. Usually, it is a series of misfortunes—a job loss, then a machine accident, so an eviction—that interact and compound.

I heard the most acute description of how this happens from Anirudh Krishna, a Duke Academy professor who has, over the concluding 15 years, interviewed more than ane,000 people who fell into poverty and escaped information technology. He started in India and Kenya, but eventually, his grad students talked him into doing the same thing in N Carolina. The mechanism, he discovered, was the same.

We frequently retrieve of poverty in America every bit a puddle, a fixed portion of the population that remains destitute for years. In fact, Krishna says, poverty is more than like a lake, with streams flowing steadily in and out all the fourth dimension. "The number of people in danger of becoming poor is far larger than the number of people who are actually poor," he says.

Nosotros're all living in a state of permanent volatility. Between 1970 and 2002, the probability that a working-historic period American would unexpectedly lose at to the lowest degree half her family income more than than doubled. And the danger is specially severe for immature people. In the 1970s, when the boomers were our age, young workers had a 24 pct chance of falling below the poverty line. By the 1990s, that had risen to 37 pct. And the numbers simply seem to exist getting worse. From 1979 to 2014, the poverty charge per unit amidst young workers with only a high schoolhouse diploma more than tripled, to 22 percent. "Millennials experience like they can lose everything at any time," Hacker says. "And, increasingly, they can."

Here'south what that downward slide looks like. Gabriel is xix years old and lives in a small town in Oregon. He plays the piano and, until recently, was saving up to study music at an arts college. Last summer he was working at a health supplement company. It wasn't the nigh glamorous chore, lugging boxes and blending ingredients, only he fabricated $12.fifty an hour and he hoped he could step upward to a improve position if he proved himself.

Then his sister got into a motorcar blow, T-boned turning into their driveway. "She couldn't walk; she couldn't call back," Gabriel says. His mom wasn't able to take a day off without risking losing her job, and then Gabriel called his boss and left a bulletin saying he had to miss piece of work for a day to go his sis habitation from the hospital.

Boomer

Millennial

Average annual stock market returns on 401(m) plans

Source: "The changing equation: Edifice for retirement in a low render world," BlackRock, October 2016. Percentages based on average returns from 1978-2016 for boomers and projected returns from 2016 onward for millennials.

The next 24-hour interval, his temp agency chosen: He was fired. Though Gabriel says no one had told him, the company had a three-strikes policy for unplanned absences. He had already missed 1 day for a cold and some other for a staph infection, so this was it. A former colleague told him that his absences meant he was unlikely to go a job there once more.

And so now Gabriel works at Taco Time and lives in a trailer with his mom and his sisters. Nigh of his paycheck goes to gas and groceries considering his mom's income is disappearing into the family's medical bills. He still wants to go to college. But since he tin can barely keep his head above h2o, he's set up his sights on an electrician'due south apprenticeship program offered by a local nonprofit. "I don't understand why it's so hard to practise something with your life," he tells me.

The answer is brutally simple. In an economy where wages are precarious and the safety internet has been hacked into ribbons, one slice of bad luck tin easily become a years-long struggle to become dorsum to normal.

Over the last four decades, there has been a profound shift in the relationship between the regime and its citizens. In The Age of Responsibility, Yascha Mounk, a political theorist, writes that earlier the 1980s, the thought of "responsibleness" was understood as something each American owed to the people around them, a national projection to keep the about vulnerable from falling below bones subsistence. Even Richard Nixon, not exactly known for lifting up the downtrodden, proposed a national welfare benefit and a version of a guaranteed income. But nether Ronald Reagan and and then Bill Clinton, the pregnant of "responsibility" changed. It became individualized, a duty to earn the benefits your land offered you.

Since 1996, the percentage of poor families receiving cash help from the government has fallen from 68 percent to 23 percent. No state provides cash benefits that add upward to the poverty line. Eligibility criteria take been surgically tightened, often with requirements that are counterproductive to actually escaping poverty. Take Temporary Aid for Needy Families, which ostensibly supports poor families with children. Its predecessor (with a different acronym) had the goal of helping parents of kids under 7, usually through simple cash payments. These days, those benefits are explicitly geared toward getting mothers away from their children and into the workforce as shortly as possible. A few states require women to enroll in grooming or start applying for jobs the day after they give birth.

The listing goes on. Housing assistance, for many people the difference between losing a job and losing everything, has been slashed into oblivion. (To pick just 1 example, in 2014 Baltimore had 75,000 applicants for 1,500 rental vouchers.) Food stamps, the closest matter to universal benefits we have left, provide, on average, $1.forty per meal.

In what seems like some kind of perverse joke, nearly every form of welfare now available to young people is attached to traditional employment. Unemployment benefits and workers' compensation are express to employees. The only major expansions of welfare since 1980 have been to the Earned Income Tax Credit and the Kid Tax Credit, both of which pay wages back to workers who accept already collected them.

Back when we had decent jobs and potent unions, it (kind of) made sense to provide things like wellness care and retirement savings through employer benefits. Only now, for freelancers and temps and short-term contractors—i.e., usa—those benefits might every bit well exist Monopoly coin. Twoscore-i pct of working millennials aren't even eligible for retirement plans through their companies.

And and then there's health intendance.

In 1980, 4 out of 5 employees got wellness insurance through their jobs. Now, simply over half of them do. Millennials can stay on our parents' plans until nosotros turn 26. But the cohort right later, 26- to 34-twelvemonth-olds, has the highest uninsured charge per unit in the country and millennials—alarmingly—take more commonage medical debt than the boomers. Even Obamacare, one of the few expansions of the prophylactic cyberspace since man walked on the moon, still leaves usa out in the open. Millennials who can afford to buy plans on the exchanges face premiums (side by side year mine will be $388 a month), deductibles ($850) and out-of-pocket limits ($5,000) that, for many immature people, are too high to absorb without assist. And of the events that precipitate the spiral into poverty, according to Krishna, an injury or disease is the most mutual trigger.

"All of united states of america are one life outcome away from losing everything," says Ashley Lauber, a bankruptcy lawyer in Seattle and an Old Millennial similar me. For most of her clients under 35, she says, the slide toward bankruptcy starts with a motorcar blow or a medical beak. "You lot can't afford your deductible, and then you go to Moneytree and have out a loan for a few hundred bucks. Then yous miss your payments and the collectors showtime calling you at piece of work, telling your boss you lot tin't pay. Then he gets ill of information technology and he fires you and it all gets worse." For a lot of her millennial clients, Lauber says, the departure between escaping debt and going bankrupt comes down to the merely condom net they have—their parents.

But this fail-safety, like all the others, isn't equally available to everyone. The wealth gap between white and non-white families is massive. Since basically forever, almost every avenue of wealth creation—college instruction, homeownership, access to credit—has been denied to minorities through discrimination both obvious and invisible. And the disparity has only grown wider since the recession. From 2007 to 2010, black families' retirement accounts shrank by 35 percent, whereas white families, who are more likely to have other sources of money, saw their accounts grow by ix percent.

The issue is that millennials of color are even more than exposed to disaster than their peers. Many white millennials have an iceberg of accumulated wealth from their parents and grandparents that they can depict on for help with tuition, rent or a identify to stay during an unpaid internship. According to the Constitute on Assets and Social Policy, white Americans are 5 times more than probable to receive an inheritance than black Americans—which can exist enough to make a down payment on a house or pay off student loans. By contrast, 67 percent of black families and 71 percent of Latino families don't have plenty money saved to cover 3 months of living expenses.

And so, instead of receiving help from their families, millennials of colour are more than likely to exist called on to provide it. Any extra income from a new job or a raise tends to become swallowed by bills or debts that many white millennials had help with. Four years afterward graduation, black college graduates have, on average, nearly twice as much student debt as their white counterparts and are three times more than probable to exist backside on payments. This financial undertow is captured in ane staggering statistic: Every extra dollar of income earned past a center-class white family generates $5.19 in new wealth. For blackness families, it's 69 cents.

Arc of Injustice

The racial wealth gap isn't merely glaring. It'south growing.

Blackness Wealth White Wealth

The median white household will take 10 15 16 69 86 more wealth than the median black household by 2020.

Sources: "The Road to Zero Wealth," Found for Policy Studies, September 2017 and "Household Wealth Trends In The The states, 1962-2013: What Happened Over the Great Recession?" National Bureau of Economic Research, Dec 2014.

Want to get even more depressed? Sit downwards and think about what's going to happen to us when we get sometime. Despite all the stories you read about flighty millennials refusing to plan for retirement (equally if our grandparents were obsessing over the details of their pension plans when they were 25), the biggest problem nosotros face is non financial illiteracy. It is compound involvement.

In the coming decades, the returns on 401(k) plans are expected to fall by half. According to an assay past the Employee Benefit Research Found, a drop in stock market place returns of just 2 per centum points ways a 25-twelvemonth-old would have to contribute more than double the amount to her retirement savings that a boomer did. Oh, and she'll have to exercise it on lower wages. This scenario gets even more dire when yous consider what'southward going to happen to Social Security by the fourth dimension we brand it to 65. There, too, it seems inevitable that nosotros're going to get screwed by demography: In 1950, there were 17 American workers to support each retiree. When millennials retire, there volition be just two.

At that place's 1 style that many Americans have traditionally managed to build wealth for themselves, to achieve some kind of dignity and condolement in onetime age. I'm talking, of course, about homeownership. At to the lowest degree we've got a shot at that, right?

Whenever Tyrone moves into a new apartment, he lies down naked on his living room floor.

It's a ritual, a reminder of the years he spent without a floor underneath him or a ceiling above. He was homeless for iv years in Georgia: sleeping on benches, biking to interviews in the heat, arriving an hour early and so he wouldn't be sweaty for the handshake. When he finally got a job, his co-workers found out that he washed himself in gas station bathrooms and made him so miserable he quit. "They said I 'smelled homeless,'" he says.

Tyrone moved to Seattle half-dozen years agone, when he was 23, because he'd heard the minimum wage there was almost double what he made in Atlanta. He got a job at a grocery store and slept in a shelter while he saved. Since so, his income has gone up, but he's been pushed further and farther from the city. First finish was subsidized housing in Kirkland, 20 minutes e beyond the lake. Then a rented house in Tacoma, 45 minutes south, sharing a bedroom with his girlfriend and, somewhen, a son. The breakup is why he's now in Lakewood, even farther south, in a one-bedroom right adjacent to a freeway entrance.

And it'due south already such a strain. Tyrone earns $17 an hour equally a security guard at a edifice site, his highest wage ever. But he's a contractor (of course), so he doesn't get ill leave or health insurance. His hire is $i,100 a month. It'due south more than he can beget, but he could only find 1 building that would let him move in without paying the full deposit in advance.

Since rent is due on the 1st and he gets paid on the 7th, his landlord adds a $100 late fee to each month'south bill. After that and the car payments—it's a 2-hour bus ride from the suburb where he lives to the suburb where he works—he has $200 left over every month for food. The offset time nosotros met, information technology was the 27th of the calendar month and Tyrone told me his account was already zeroed out. He had pawned his skateboard the previous dark for gas money.

Despite the acres of news pages dedicated to the narrative that millennials refuse to grow up, there are twice as many young people like Tyrone—living on their own and earning less than $30,000 per yr—as in that location are millennials living with their parents. The crisis of our generation cannot be separated from the crunch of affordable housing.

More than people are renting homes than at any time since the late 1960s. Merely in the twoscore years leading up to the recession, rents increased at more than than twice the rate of incomes. Between 2001 and 2014, the number of "severely burdened" renters—households spending over half their incomes on rent—grew by more than l percent. Rather unsurprisingly, equally housing prices have exploded, the number of 30- to 34-twelvemonth-olds who own homes has plummeted.

Falling homeownership rates, on their own, aren't necessarily a catastrophe. Just our state has contrived an entire "Game of Life" sequence that hinges on being able to buy a domicile. You rent for a while to save upwards for a down payment, then you buy a starter home with your partner, then you move into a larger place and raise a family unit. In one case you pay off the mortgage, your firm is either an asset to sell or a cheap place to alive in retirement. Fin.

This worked well when rents were depression enough to save and homes were cheap enough to buy. In ane of the most infuriating conversations I had for this article, my male parent breezily informed me that he bought his offset house at 29. Information technology was 1973, he had just moved to Seattle and his task as a university professor paid him (adjusted for aggrandizement) around $76,000 a year. The house price $124,000 — again, in today's dollars. I am six years older now than my dad was then. I earn less than he did and the median habitation price in Seattle is effectually $730,000. My begetter'south first house cost him 20 months of his salary. My showtime firm will cost more than 10 years of mine.

Here's your city. Here'south downtown. That'southward where lots of the expert jobs are.

Nearly people want to live fewer than 30 minutes from work. So, for much of the 20th century, big cities built housing shut to jobs.

When the inner ring of suburbs filled upwards, cities congenital freeways to whisk workers to the next.

But so those suburbs filled upwards. Traffic got worse. Thirty-minute commutes became 45-infinitesimal commutes.

Need for houses close to downtown exploded.

For a long time, that'south what cities did. They built upward, divided homes into apartments and added duplexes and townhomes.

Simply in the 1970s, they stopped building. Cities kept calculation jobs and people. But they didn't add more housing. And that'due south when prices started to climb.

Then much of this can be explained by one give-and-take:

At first, zoning was pretty pocket-size. The indicate was to terminate someone from ownership your neighbor's house and turning information technology into an oil refinery.

Only somewhen people realized they could apply zoning for other purposes.

In the tardily 1960s, it finally became illegal to deny housing to minorities. Then cities instituted weirdly specific rules that drove up the price of new houses and excluded poor people—who were, unduly, minorities.

Houses had to take massive backyards. They couldn't be split into separate apartments. Basically, cities mandated McMansions.

We're still living with that legacy. Across huge swaths of American cities, it'southward pretty much illegal to build affordable housing.

And this trouble is only getting worse.

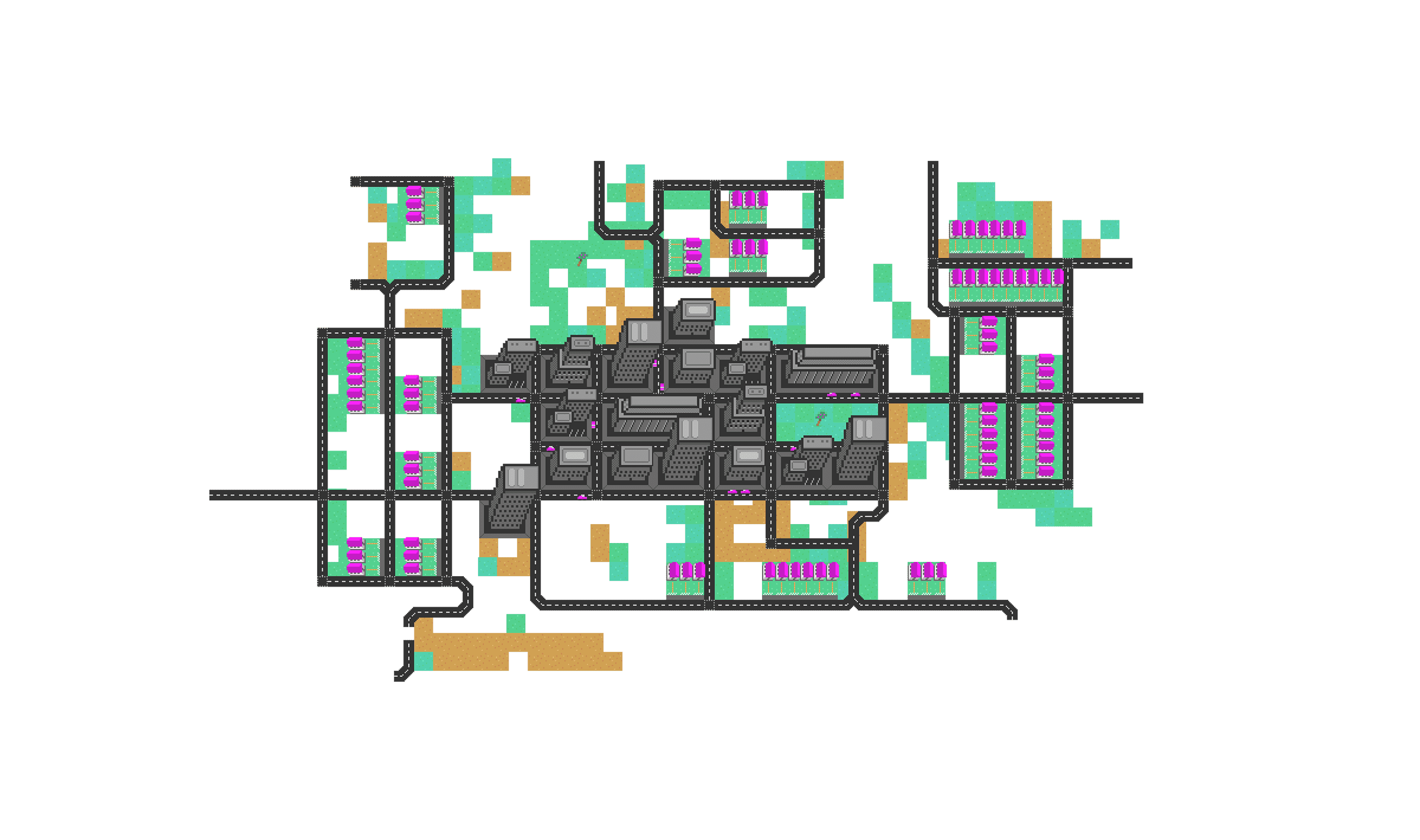

That's because all the urgency to build comes from people who need somewhere to live. Only all the political ability is held past people who already own homes.

For homeowners, there's no such thing as a housing crisis.

Why?

Because when property values go upwardly, so does their cyberspace worth. They have every reason to block new construction.

They do that by weaponizing environmental regulations and historical preservation rules.

They forcefulness buildings to be shorter and then they don't cast shadows. They demand two parking spaces for every single unit.

They complain that a new apartment building will destroy "neighborhood character" when the structure information technology'south replacing is… a parking garage. (True story.)

All this extra hassle means construction takes longer and costs more than.

Which ways that the just way almost developers can brand a turn a profit is to build luxury condos.

So that'southward why cities are so unaffordable. The entire system is structured to produce expensive housing when we desperately need the reverse.

The housing crisis in our about prosperous cities is now distorting the entire American economic system. For most of the 20th century, the way many workers improved their financial fortunes was to move closer to opportunities. Rents were college in the boomtowns, only and then were wages.

Since the Swell Recession, the "good" jobs—secure, not-temp, decent salary—have concentrated in cities like never before. America's 100 largest metros accept added vi million jobs since the downturn. Rural areas, meanwhile, however have fewer jobs than they did in 2007. For young people trying to find work, moving to a major city is not an indulgence. Information technology is a virtual necessity.

Only the soaring rents in large cities are now canceling out the college wages. Dorsum in 1970, according to a Harvard report, an unskilled worker who moved from a low-income state to a high-income land kept 79 percent of his increased wages after he paid for housing. A worker who fabricated the same move in 2010 kept just 36 percentage. For the first time in U.S. history, says Daniel Shoag, i of the study's co-authors, it no longer makes sense for an unskilled worker in Utah to head for New York in the promise of building a better life.

This leaves young people, especially those without a college caste, with an impossible choice. They tin move to a city where there are good jobs but insane rents. Or they can move somewhere with depression rents but few jobs that pay above the minimum wage.

This dilemma is feeding the inequality-generating woodchipper the U.S. economy has become. Rather than offer Americans a manner to build wealth, cities are condign concentrations of people who already accept information technology. In the country's 10 largest metros, residents earning more $150,000 per year at present outnumber those earning less than $thirty,000 per year.

Millennials who are able to relocate to these oases of opportunity go to relish their many advantages: better schools, more generous social services, more rungs on the career ladder to catch on to. Millennials who can't beget to relocate to a big expensive city are … stuck. In 2016, the Census Bureau reported that young people were less likely to have lived at a different address a year earlier than at any fourth dimension since 1963.

And then the real reason millennials can't seem to achieve the adulthood our parents envisioned for us is that we're trying to succeed within a system that no longer makes any sense. Homeownership and migration take been pitched to us equally gateways to prosperity considering, dorsum when the boomers grew up, they were. But now, the rules have changed and we're left playing a game that is impossible to win.

Which means

We start earning less coin, later. We have more debt and higher hire.

we aren't able to salve.

we can't buy a firm or fix for retirement.

that unless something changes… All of u.s.a. are headed for a very dark place.

Just wait. Wuttt? Why is this all so hard?

The most striking affair nearly the problems of millennials is how intertwined and self-reinforcing and everywhere they are.

Over the eight months I spent reporting this story, I spent a few evenings at a youth homeless shelter and met unpaid interns and gig-economy bike messengers saving for their first month of rent. During the days I interviewed people like Josh, a 33-yr-old affordable housing developer who mentioned that his female parent struggles to make ends meet as a contractor in a profession that used to be reliable regime piece of work. Every Thanksgiving, she reminds him that her retirement plan is a "401(j)"—J for Josh.

Fixing what has been done to us is going to take more than than tinkering. Even if economic growth picks upwards and unemployment continues to fall, nosotros're still on a rail toward always more than insecurity for immature people. The "Get out It To Beaver" workforce, in which everyone has the aforementioned job from graduation until gold scout, is not coming back. Any effort to recreate the economical conditions the boomers had is just sending lifeboats to a whirlpool.

Simply still, there is already a foot-long list of overdue federal policy changes that would at least begin to fortify our hereafter and reknit the safety internet. Even amid the awfulness of our political moment, nosotros can starting time to build a platform to rally around. Heighten the minimum wage and tie it to inflation. Coil back anti-union laws to give workers more than leverage against companies that care for them every bit if they're dispensable. Tilt the tax code abroad from the wealthy. Right now, rich people tin write off mortgage interest on their 2d home and expenses related to being a landlord or (I'1000 not kidding) owning a racehorse. The residue of usa can't even deduct student loans or the cost of getting an occupational license.

Some of the trendiest Big Policy Fixes these days are efforts to rebuild government services from the basis upward. The ur-case is the Universal Basic Income, a no-questions-asked monthly cash payment to every single American. The thought is to institute a level of basic subsistence below which no one in a civilized country should exist allowed to fall. The venture capital letter business firm Y Combinator is planning a airplane pilot program that would requite $ane,000 each month to ane,000 depression- and middle-income participants. And while, yes, it's inspiring that a pro-poor policy thought has won the support of D.C. wonks and Ayn Rand tech bros akin, it'southward worth noting that existing programs similar nutrient stamps, TANF, public housing and government-subsidized day care are non inherently ineffective. They accept been intentionally made so. It would be nice if the people excited by the shiny new programs would expend a little endeavor defending and expanding the ones nosotros already have.

But they're right well-nigh 1 thing: We're going to need government structures that respond to the fashion we piece of work now. "Portable benefits," an thought that's been bouncing around for years, attempts to break downward the zero-sum distinction betwixt full-time employees who get authorities-backed worker protections and independent contractors who get nothing. The manner to solve this, when you lot remember about information technology, is ridiculously uncomplicated: Attach benefits to work instead of jobs. The existing proposals vary, only the adept ones are based on the same principle: For every hour you work, your boss chips in to a fund that pays out when you get sick, pregnant, old or fired. The fund follows yous from job to task, and companies accept to contribute to it whether you piece of work at that place a day, a month or a year.

Modest versions of this thought accept been offsetting the inherent insecurity of the gig economy since long before we called information technology that. Some structure workers have an "hour bank" that fills upward when they're working and provides benefits fifty-fifty when they're between jobs. Hollywood actors and technical staff have health and pension plans that follow them from pic to motion-picture show. In both cases, the benefits are negotiated by unions, but they don't have to be. Since 1962, California has offered "elective coverage" insurance that allows contained contractors to file for payouts if their kids go sick or if they become injured on the job. "The offloading of risks onto workers and families was not a natural occurrence," says Hacker, the Yale political scientist. "It was a deliberate effort. And nosotros can roll it dorsum the same way."

Some other no-brainer experiment is to expand jobs programs. Every bit decent opportunities have dwindled and wage inequality has soared, the government'due south bulletin to the poorest citizens has remained exactly the same: Y'all're not trying hard enough. Simply at the same time, the authorities has non actually attempted to give people jobs on a large scale since the 1970s.

Because most of us grew up in a world without them, jobs programs can sound overly aggressive or suspiciously Leninist. In fact, they're neither. In 2010, equally role of the stimulus, Mississippi launched a program that merely reimbursed employers for the wages they paid to eligible new hires—100 percent at get-go, so tapering downwardly to 25 percent. The initiative primarily reached low-income mothers and the long-term unemployed. Near half of the recipients were nether 30.

The results were impressive. For the average participant, the subsidized wages lasted only 13 weeks. Yet the year after the program concluded, long-term unemployed workers were still earning well-nigh ix times more than they had the previous twelvemonth. Either they kept the jobs they got through the subsidies or the experience helped them detect something new. Plus, the program was a bargain. Subsidizing more than than three,000 jobs cost $22 1000000, which existing businesses doled out to workers who weren't required to go special training. Information technology wasn't an isolated success, either. A Georgetown Center on Poverty and Inequality review of 15 jobs programs from the past 4 decades concluded that they were "a proven, promising, and underutilized tool for lifting up disadvantaged workers." The review institute that subsidizing employment raised wages and reduced long-term unemployment. Children of the participants even did better at school.

Just earlier I become carried away listing urgent and obvious solutions for the plight of millennials, let'due south pause for a bit of reality: Who are we kidding? Donald Trump, Paul Ryan and Mitch McConnell are not interested in our innovative proposals to lift up the systemically disadvantaged. Their entire political calendar, from the Scrooge McDuck tax reform bill to the ongoing assassination endeavour on Obamacare, is explicitly designed to turbocharge the forces that are causing this misery. Federally speaking, things are just going to get worse.

Which is why, for now, we demand to take the fight to where we tin win it.

Over the last decade, states and cities have made remarkable progress adapting to the new economy. Minimum-wage hikes take been passed by voters in 9 states, even night red rectangles like Nebraska and South Dakota. Following a long campaign by the Working Families Political party and other activist organizations, eight states and the District of Columbia have instituted guaranteed sick leave. Bills to gainsay exploitative scheduling practices accept been introduced in more than than a dozen country legislatures. San Francisco now gives retail and fast-food workers the right to learn their schedules two weeks in advance and get compensated for sudden shift changes. Local initiatives are pop, effective and our best hope of preventing the land'due south slide into "Mad Max"-fashion individualism.

The court organisation, the but branch of our government currently functioning, offers other encouraging avenues. Grade-action lawsuits and state and federal investigations have resulted in a wave of judgments against companies that "misclassify" their workers as contractors. FedEx, which requires some of its drivers to buy their own trucks and so work as independent contractors, recently reached a $227 million settlement with more than than 12,000 plaintiffs in 19 states. In 2014, a startup called Hello Alfred—Uber for chores, basically—announced that information technology would rely exclusively on directly hires instead of "1099s." Part of the reason, its CEO told Fast Company, was that the legal and financial adventure of relying on contractors had gotten too high. A tsunami of similar lawsuits over working weather condition and wage theft would be enough to force the same calculation onto every CEO in America.

of millennials with student loans have delayed a major life upshot—including getting married or having kids—because of their debt

Source: Bankrate Coin Pulse survey, July 2015. Percent is for immature adults ages 18-29.

And then there'south housing, where the potential—and necessity—of local activity is obvious. This doesn't but mean showing up to metropolis council hearings to drown out the NIMBYs (though let's definitely do that). It also ways ensuring that the entire system for approving new structure doesn't prioritize homeowners at the expense of anybody else. Correct now, permitting processes examine, in excruciating detail, how one new edifice volition affect rents, racket, traffic, parking, shadows and squirrel populations. But they never investigate the consequences of not building anything—ascension prices, displaced renters, low-wage workers commuting hours from outside the sprawl.

Some cities are finally acknowledging this reality. Portland and Denver have sped up approvals and streamlined permitting. In 2016, Seattle'due south mayor announced that the city would cut ties with its mostly quondam, mostly white, very NIMBY district councils and establish a "community involvement commission." The proper name is terrible, obviously, merely the mandate is groundbreaking: Include renters, the poor, indigenous minorities—and anybody else unable to attend a consultation at two p.g. on a Wed—in construction decisions. For decades, politicians have been terrified of making the slightest twitch that might upset homeowners. But with renters now outnumbering owners in nine of America'due south xi largest cities, we accept the potential to be a powerful political constituency.

The same logic could be practical to our entire generation. In 2018, there will be more millennials than boomers in the voting-age population. The problem, every bit you've already heard a million times, is that we don't vote enough. Only 49 percent of Americans ages 18 to 35 turned out to vote in the terminal presidential ballot, compared to about lxx percent of boomers and Greatests. (It'due south lower in midterm elections and positively dire in primaries.)

But like everything most millennials, once you dig into the numbers you notice a more than complicated story. Youth turnout is depression, sure, but not universally. In 2012, it ranged from 68 percent in Mississippi (!) to 24 percent in Due west Virginia. And across the country, younger Americans who are registered to vote show up at the polls near as often as older Americans.

The fact is, information technology's simply harder for u.s.a. to vote. Consider that nearly one-half of millennials are minorities and that voter suppression efforts are laser-focused on blacks and Latinos. Or that united states with the simplest registration procedures take youth turnout rates significantly college than the national average. (In Oregon it's automatic, in Idaho you can do information technology the same twenty-four hours you vote and in North Dakota you don't have to register at all.) Adopting voting rights as a cause—forcing politicians to listen to us similar they do to the boomers—is the merely way we're ever going to get a shot at creating our own New Deal.

Or, as Shaun Scott, the writer of Millennials and the Moments That Made Us, told me, "We tin can either do politics or we tin have politics washed to us."

And that's exactly information technology. The boomer-benefiting system nosotros've inherited was not inevitable and it is non irreversible. In that location is nevertheless a choice here. For the generations ahead of us, it is whether to laissez passer down some of the opportunities they enjoyed in their youth or to go along hoarding them. Since 1989, the median wealth of families headed by someone over 62 has increased 40 percent. The median wealth of families headed by someone under 40 has decreased by 28 pct. Boomers, it's upward to you: Do you want your children to accept decent jobs and places to live and a not-Dickensian former historic period? Or exercise you want lower taxes and more than parking?

And so there's our responsibility. We're used to feeling helpless considering for near of our lives we've been bailiwick to huge forces across our control. But pretty soon, we'll actually be in charge. And the question, as we age into power, is whether our children will ane day write the aforementioned article well-nigh us. We tin let our economic infrastructure keep disintegrating and expect to run into if the rising seas get us earlier our social contract dies. Or we can build an equitable time to come that reflects our values and our demographics and all the chances we wish nosotros'd had. Perhaps that sounds naïve, and maybe it is. Just I think nosotros're entitled to it.

Credits

Michael is a contributing writer for Highline.

Typography - Jason Wong

Jason is an art director and graphic designer based in suburban New Jersey.

He is also a part of the lettering sketch blog

Friends of Type.

Spiritual Guide - Becky

Becky is an 8-chip creation living in Brooklyn. Y'all tin find her Kickstarter

here.

Highline

Creative Management and Design Sandra Garcia

Executive Editors Rachel Morris and Greg Veis

Story Editor Rachel Morris

Senior Designer Pablo Espinosa

Senior Developer Chris Lam

Interactive Developer William Hamlin

Interaction Designer Sophie Lee

Head of Production Conrad Bane

Account Manager Steph Coulton

Additional reporting Gregory Barber

Enquiry Delphine d'Amora, Will Stephenson

Special thanks

Sara Bondioli, Alexander Eichler and Ani Vrabel

Photograph credits

Snapchat prototype: "Allie Mae Burroughs" Walker Evans/Library of Congress

Photograph collages of fake online ads and housing imagery: Getty, 145President.com, Unsplash

1950s family photo: Getty Images/H. Armstrong Roberts/ClassicStock

Source: http://highline.huffingtonpost.com/articles/en/poor-millennials

Posted by: eaglewelinigh.blogspot.com

0 Response to "How Can Millenials Change Things When They Have No Money"

Post a Comment